Self employed payroll calculator

Employees who receive a W-2 only pay half of the total. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Paycheck Calculator Take Home Pay Calculator

Self employed people pay a.

. Self employment taxes are comprised of two parts. Free Unbiased Reviews Top Picks. Our self-employed and sole trader income.

Get Started With ADP Payroll. See what happens when you are both employed and self. How do I calculate my monthly self-employment income.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use this Self-Employment Tax Calculator to estimate your. Ad Compare This Years Top 5 Free Payroll Software.

Taxes Paid Filed - 100 Guarantee. If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016. Whether youre employed self-employed or a combination of both working out your take home pay after tax can be tricky.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. You pay 7092 40 on your self-employment. The rate consists of two parts.

Ad Compare This Years Top 5 Free Payroll Software. Here is how to calculate your quarterly taxes. Employed and self-employed tax calculator.

This percentage is a combination of Social Security and Medicare tax. Ad Easy To Run Payroll Get Set Up Running in Minutes. Use the IRSs Form 1040-ES as a worksheet to determine your.

Ad Access Tax Forms. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves.

For example say year one the business. Taxes Paid Filed - 100 Guarantee. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235.

Workers pay only payroll tax brought to workers for Social Security and health insurance while self-employed workers must pay half to employers thereby raising the maximum tax rate to. Ad Process Payroll Faster Easier With ADP Payroll. Social Security and Medicare.

Self-employed workers are taxed at 153 of the net profit. The self-employment tax rate is 153. Free Unbiased Reviews Top Picks.

Sponsored Links Sponsored Links Payroll Information. Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2022-2023 tax year. You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first.

When you put together a business budget youll need to include the amounts you have to pay towards Tax and National Insurance NI. Calculate your adjusted gross income from self-employment for the year. Our employed and self-employed calculator gives you an estimated income and national.

Calculate your paycheck withholdings for free. This is your total income subject to self-employment taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. They calculate your income by adding it up and dividing by 24 months.

This tax is also known as the FICA Medicare or social security tax and is. Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Paycheck Calculator Take Home Pay Calculator

Self Employment Tax Calculator To Calculate Medicare And Ss Taxes

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Llc Tax Calculator Definitive Small Business Tax Estimator

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

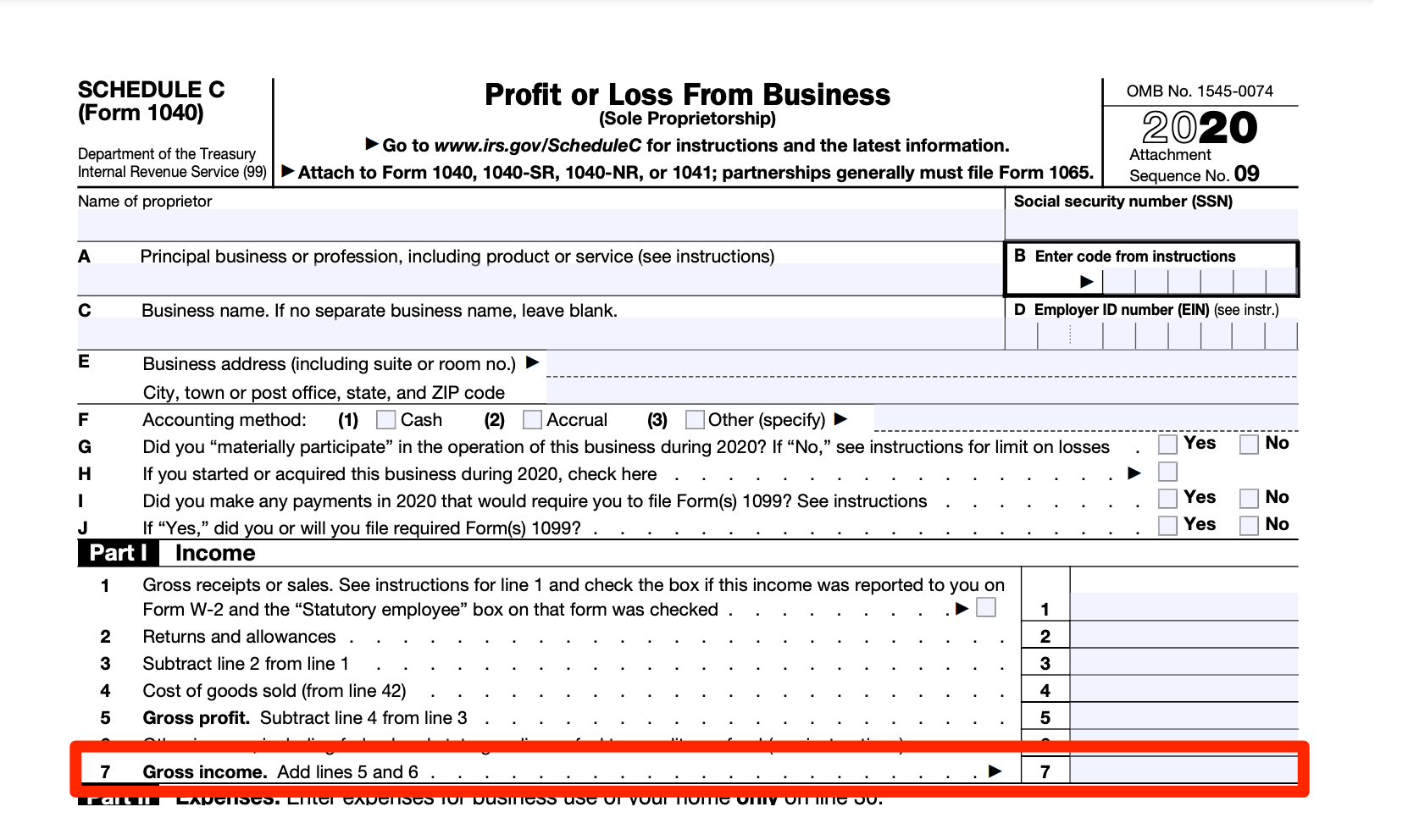

How To Calculate Gross Income For The Ppp Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Payroll Calculator Free Employee Payroll Template For Excel

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

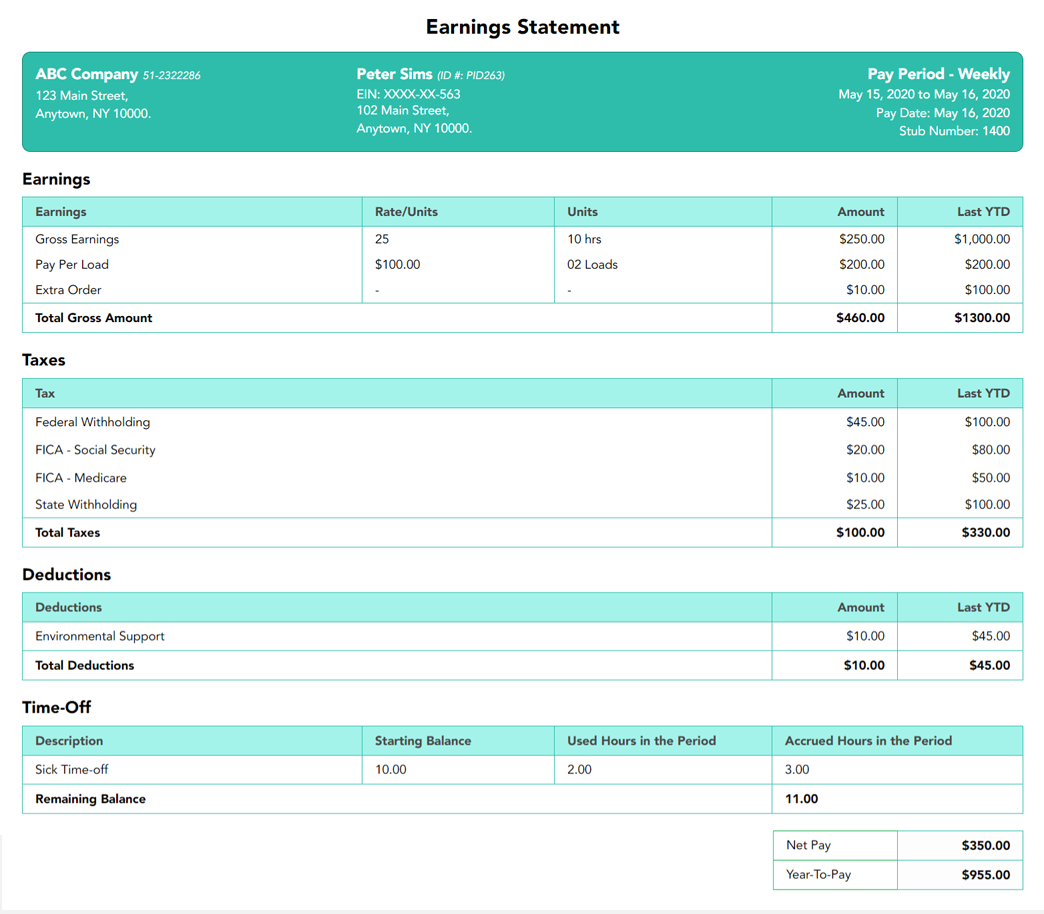

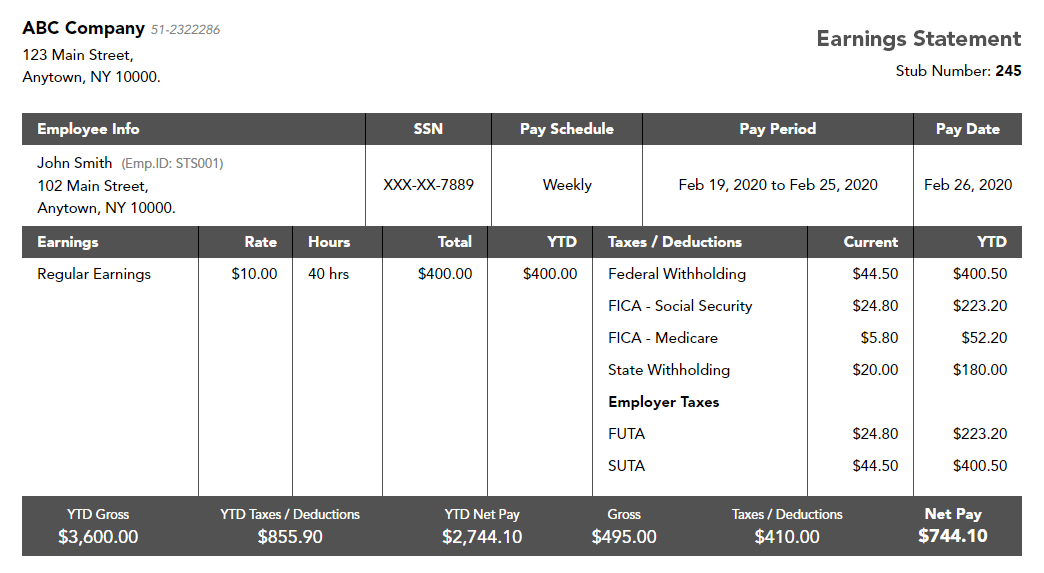

Free Paystub Generator For Self Employed Individuals

Free Paystub Generator For Self Employed Individuals

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps